Equities Markets Certification – Bundle (Wall Street Prep) – Eric Cheung

This self-paced EMC certification program prepares trainees with the skills they need to succeed as an Equities Markets Trader on either the Buy Side or Sell Side.

-

Earn a certification

Shareable on LinkedIn and in resumes

-

Finish in 1 month

Recommended pace 2-3 hours/week

-

Globally Recognized

The same program used at top banks

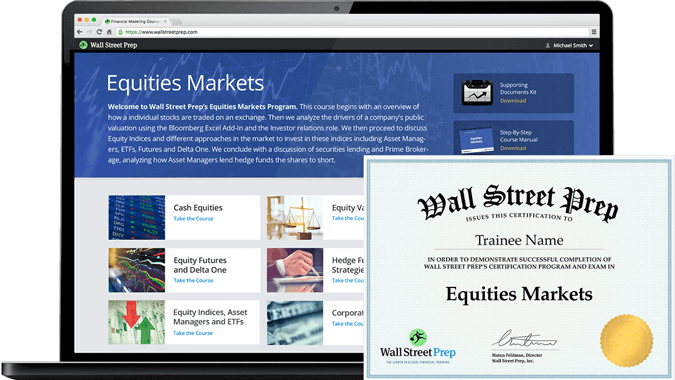

About this Certification Program

While other Equities Markets courses add formulas and complexity to hide the lack of real-world experience, Wall Street Prep’s Equities Markets Certification was created by former sales and trading professionals focused on what interns, new hires, and early career analysts need to know on the job.

Designed following extensive discussion with hiring managers at major investment banks, we built our Equities Markets program around gaining the practical knowledge needed of growing markets such as ETFs, Delta One and Prime Brokerage.

-

Taught by Markets Professionals Master how to use the Bloomberg terminal to analyze financial statements, find consensus EPS and monitor short interest.

-

A Comprehensive ProgramDesigned with input from the largest global investment banks on what Equities Markets salespeople and traders need to know.

-

Meaningful, Shareable Certification Graduates will receive a blockchain-verified, shareable certification that can easily be added to LinkedIn and resumes.

Your Path to Certification

This course is career-focused. We begin with an overview of how a individual stocks are traded on an exchange. Then we analyze the drivers of a company’s public valuation using the Bloomberg Excel Add-In and the investor relations role; proceed to discuss equity indices and different approaches in the market to invest in these indices including asset managers, ETFs, futures and Delta One; and conclude with a discussion of securities lending and prime brokerage, analyzing how asset managers lend hedge funds the shares to short.

Recommended Path

- 1 Cash Equities Week 1

- 2 Equity Valuation Week 1

- 3 Equity Indices, Asset Managers and ETFs Week 2

- 4 Equity Futures and Delta One Week 3

- 5 Hedge Fund Strategies Week 3

- 6 Securities Lending and Prime Brokerage Week 4

Complete in 10 Hours

The EMC is a job-focused program that drills down on what Equities Markets professionals need to know while cutting out the rest. Average completion time (coursework + exam) is 10 hours.

Skills Equities Markets Employers Look For

- Fixed Income

Covered

- Bloomberg

Covered

- Hedging

Covered

- Trading

Covered

- Derivatives

Covered

Top Jobs the EMC Will Prepare You For

| Position | 1st Year Salary + Bonus * |

|---|---|

| Delta One Trader | $135-160,000 |

| ETF Trader | $135-160,000 |

| Buy Side Trader | $105-130,000 |

| Hedge Fund Trader | $150-175,000 |

| Cash Equities Sales Trader | $100-125,000 |

| Cash Equities Sales Researcher | $100-125,000 |

| Securities Lending Analyst | $90-115,000 |

| Prime Brokerage Analyst | $105-130,000 |

* glassdoor.com estimates.

$128K

The average starting salary + bonus for Equity Sales & Trading Analysts. See our Sales & Training Salary Guide for more details of the career and pay progression. Data on starting salaries is taken from glassdoor.com U.S. estimates.

What You’ll Learn

- Master the technical skills and concepts that Equities traders are expected to know on the trading floor

- Learn how to chart, graph and analyze stocks, indices and futures on Bloomberg

- Speak and understand the trader jargon

- Analyze company financials using the Bloomberg Excel-Add In

- Demystify the Buy-Side business model and learn how Asset Managers and Hedge Funds are paid and their economic drivers and priorities

- Learn how ETF Traders profit from arbitrage opportunities

- Compare funded investment options (Mutual Funds, ETFs) with Unfunded investment Options (Futures and Equity Swaps)

- Discover how derivatives are traded, margined, and hedged

- Understand how to “short a stock” and the Securities Lending process

- Demystify Hedge Fund Trading strategies

The EMC© is the same program used to train new hires at Wall Street’s largest investment banks.

WSP trains investment professionals and traders at the world’s largest sell-side investment banks and buy-side asset managers.

WSP trains investment professionals and traders at the world’s largest sell-side investment banks and buy-side asset managers.

“Our employees are telling us this is the best virtual learning experience they have ever had.

— Associate Director, Learning & Development

Global Investment Bank”

This program includes the following 6 courses

Get the Equities Markets Certification

Trainees are eligible to take the WSP Equities Markets Certification Exam for 24 months from the date of enrollment. Those who complete the exam and score above 70% will receive a the certification. The exam is a challenging online assessment that covers the most difficult concepts taught in the program.

Course Samples

Meet Your Instructor

Eric Cheung

Eric is the lead instructor for Wall Street Prep’s Capital Markets and Sales & Trading programs. Eric’s financial markets career began after he was a finalist for J.P. Morgan’s Fantasy Futures trading competition. Eric worked at J.P. Morgan for 10 years across DCM, Syndicate and Sales & Trading Roles, including in the Cross Asset Sales & Structuring group with trade execution experience across all asset classes. Eric is an expert in International Markets and Cross-Border transactions with global work experience in New York, London, Hong Kong and Tokyo.

Round Out Your Markets Training Buy the FIMC© and EMC© together and save $199

- Buy both programs together for a complete Markets Training Program.

- Gain a real-world understanding of Fixed Income and Equities Markets trading.

- Learn what it takes to become a successful trader on the Buy Side and Sell Side.